Oracle ERP Cloud has been successfully deployed throughout your organization.

However, as an executive or business manager, are you struggling with getting timely analysis/insights required to monitor the health of your business? Struggling to get historical trend analysis ?

Oracle ERP Cloud, like any other Oracle SaaS applications, has embedded analytics and reporting capabilities like OTBI. Your organization can use these capabilities to manage operational finance activities. Albeit from supporting day to day operations, need for real-time transactional reporting to help business users manage daily workloads, which allows business users and managers to answer their operational questions quickly. E.g., How much unapplied cash do we have? Which invoices are on hold? Which invoices are due for payment this week?

What is the problem you ask?

Well, what we hear a lot from working with the finance team is, they struggle to:

- Provide accurate and timely analysis/insights to management and executives around planning and budgeting, Revenue and profitability analysis, monitoring business performance with KPIs requiring variance analysis and historical trend analysis.

- Measure the effectiveness/impact of actions taken to address an out of control KPI after root cause analysis.

- Respond to management and executive questions promptly. Finance analyst typically carries out time-consuming ad-hoc root cause analysis. Which involves delving more in-depth into financial data and or considering external data like HR, sales, operational data.

Below are examples of questions asked by management and executives to help determine the health of their business.

- Who are our most profitable customers?

- What are the gross margin trends for various product lines/groups?

- What are the gross margin trends by region?

- What cost-saving opportunities do we have as a company?

- Are we under or over budget with our Capex spend?

- How is Opex spend tracking against budgets?

- What’s our payroll to revenue ratio?

Why does the Finance Organization struggle?

What we have found from working with finance teams, it takes a lot of time to gather data, prepare, and turn data into meaningful insights. See a day in the life of a Finance analyst below:

- Finance organizations are spending over 80% of their time just dealing with data. Finding data, getting data from different sources, transforming data, and securing the data. Source: Data Literacy: A Foundation for Succeeding in a Data-Driven World — IDC 2019

Which leaves Finance teams little to no time left for analysis. In this case, less than 20% of time analyst time is available. - Finance organizations don’t always have enough resources to tackle this struggle.

A Day in the life of a Finance Analyst

- Extract data from Oracle ERP Cloud and other sources

- Manually pull data into spreadsheets

- Preparing and transforming the data in excel.

- Analyze data and present findings, E.g., pivot tables, graphs, dashboards, reports, etc.

The ad-hoc analysis process described is tedious, error-prone, and takes a lot of time from preparation to completion. Step 1-3 represents the 80% and Step 2 the 20% of the time available for uncovering actionable insights from the analysis.

How is Oracle addressing this critical business need in Finance?

Oracle has developed a new packaged analytics solution for the finance organization – Oracle Analytics for Applications- ERP (OAX) – Oracle Financial Analytics. Its goal is to help finance teams and executives to maximize the value of their Oracle ERP Cloud data with pre-built insights (KPIs, dashboards, reports) to answer more questions.

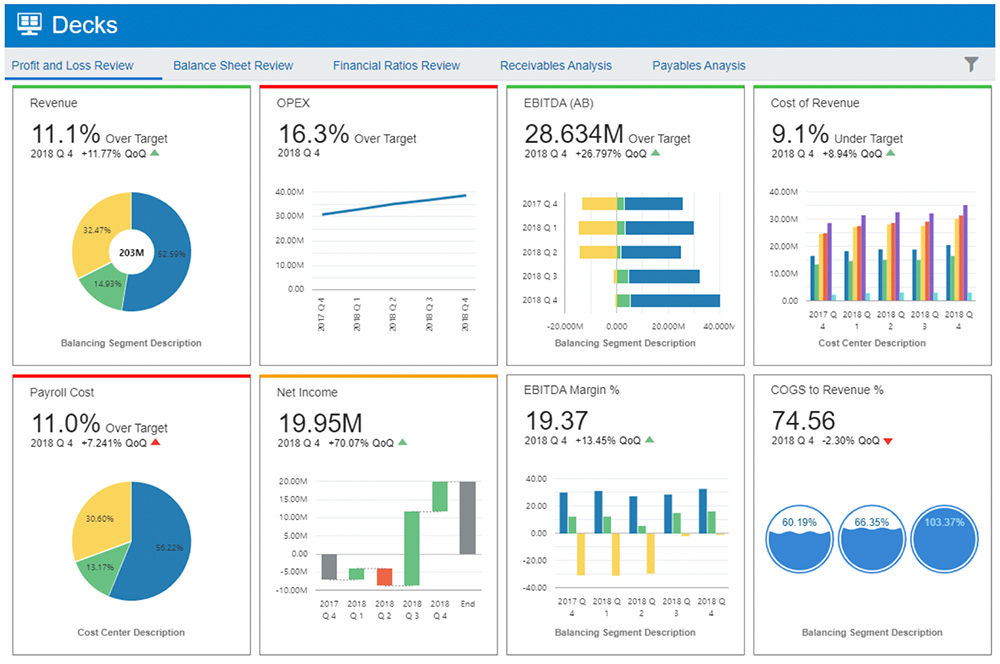

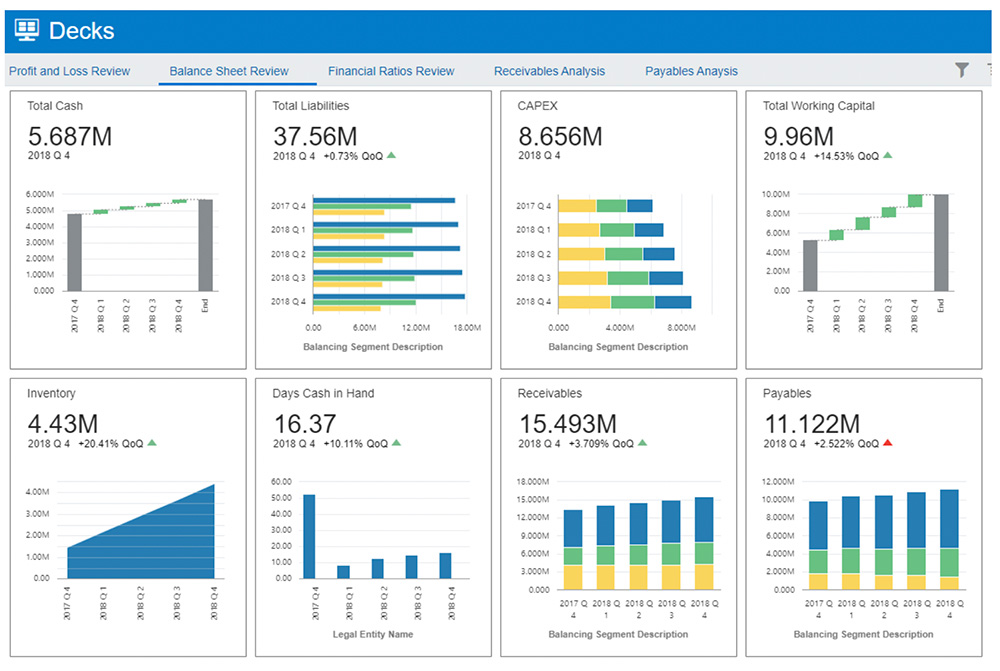

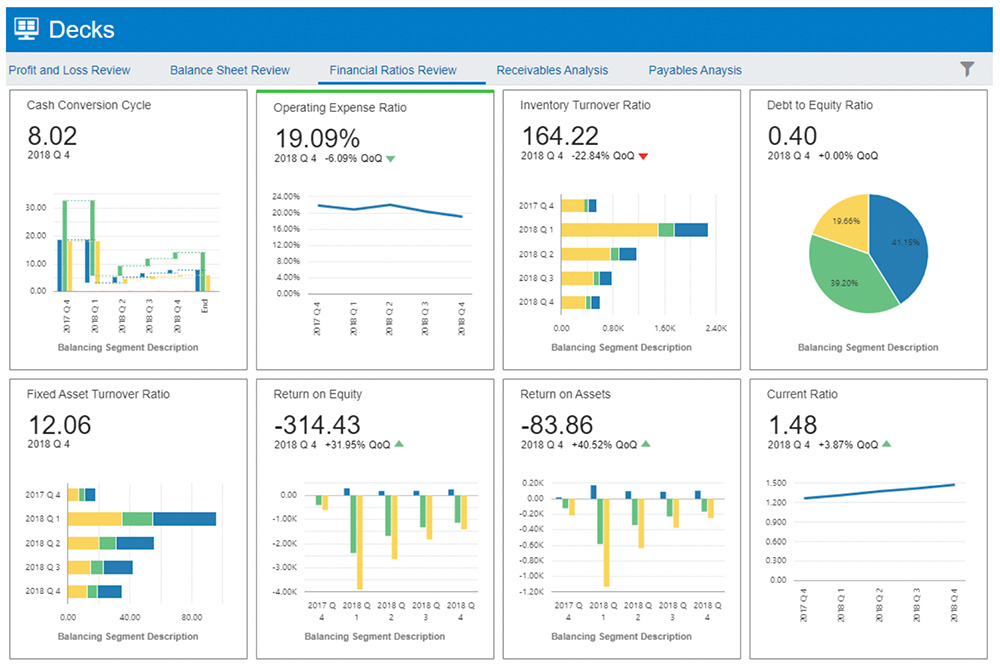

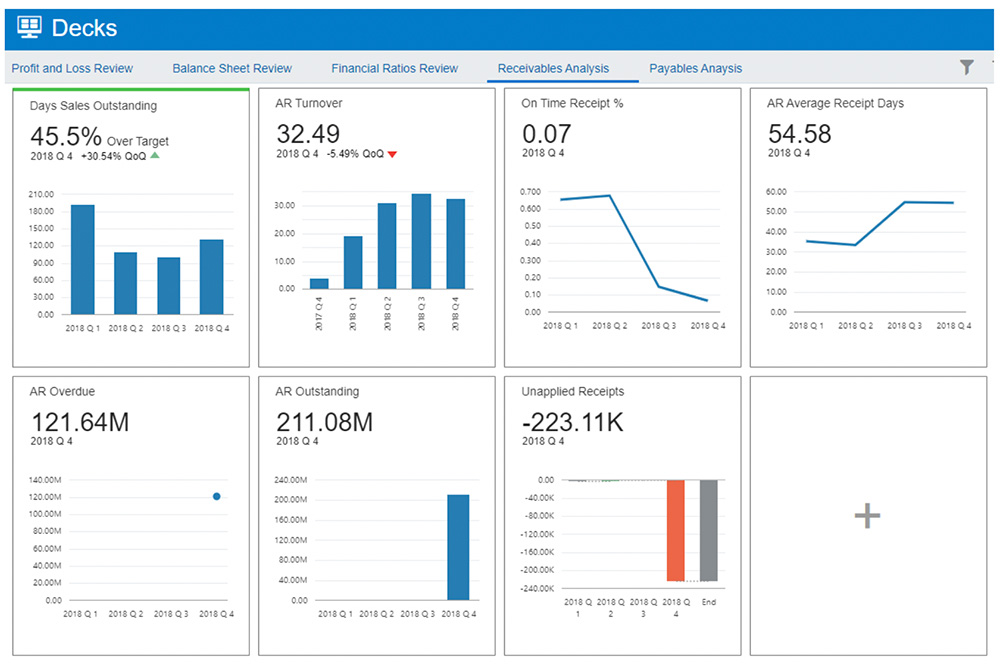

This solution provides out of the box, ready to use, pre-built KPIs to support performance monitoring needs. There are 50+ best practice KPIs that reflects the essential health of the business spanning; Profit and Loss, Balance Sheet & Financials ratios, Receivables to Payables. The solution can ingest data from on-Fusion Applications and 3rd Party applications for use within the Custom KPI.

The bottom line is your finance analyst, and business users can now spend much of their time focused on analysis instead of the data preparation. More data, more answers.

| Profit and Loss Use Cases | • Revenue • Cost of Revenue to Rev % • Gross Income • Gross margin % • Return on equity • Return on assets |

• Net Income margin • EBITDA margin % • Operating Expense Ratio • Capex • Opex • Payroll Cost |

| Balance Sheets & Ratios Use Cases | • Total Cash • Total Assets • Net Working Capital • Total Liabilities • Inventory • Days Cash on Hand • Inventory Turnover Ratio • Fixed Assets Turnover Ratio |

• Current Ratio • Debt to Equity Ratio • Quick Ratio • Cash Conversion Cycle • Days Sales Outstanding • Days Payables Outstanding • Days Inventory Outstanding |

| Receivables Use Cases | • AR Turnover Rate • AR Outstanding • AR Overdue • AR Due in Next 30 Days |

• AR Unapplied Receipts • AR Average Receipt Days • AR On-Time Receipts % • AR Outstanding for Top 10 Customers |

| Payables Use Cases | • AP Due in Next 30 Days • AP Turnover Rate • AP Invoices Processed • AP Outstanding • AP Overdue |

• AP Holds • AP Payments Processed • AP Avg Supplier Payment Days • AP On-Time Payments |

The Analytics screenshots below show ‘KPI cards’ that provide vital information at a glance across various finance use cases.

- It comes with the ability to alert business users via email when the business KPI is trending outside of the preset target.

- Visual warning – red is critical (adverse), and yellow is warning

- The actual value of KPIs can be the comparison to a goal like budgets. Including contrast to a previous time period, quarter to quarter

- Seamless collaboration with teams through discussion threads

- The ability to drill down from KPI into the embedded pages for more detailed analysis

- Any other company-specific KPI not in 50+ delivered by Oracle can be quickly built

Profit and Loss Review

Balance Sheet Review

Financial Ratios Review

Receivables Review

Payables Review

How is Oracle Analytics for Fusion ERP different from the embedded Analytics for Oracle ERP Cloud?

Oracle Analytics for Fusion ERP complements the embedded analytics with Oracle ERP Cloud to provide a COMPLETE Financial analytics solution for Oracle ERP Cloud by answering questions for everyone in the financial organization. This solution helps provide more strategic analysis/insights to help guide management and executives to determine and improve the health of their business. It’s a single source of truth.

Conclusion

To learn more about how Oracle Analytics for Fusion ERP can help your organization expand insights to more business users like managers and executives and giving analysts more power tools.