Unleash the Power of Intercompany Functionality in Oracle PPM

Understanding, setting up and using PPM intercompany functionality can seem like a daunting task. However, once configured and understood, intercompany is a powerful tool that automates intercompany processing for projects that use resources across legal entities.

This is the first of a four part blog that will explain what PPM intercompany functionality is and is not. Parts 2 ,3 and 4 will explain the key setups of PPM Intercompany, how to execute transactions and the differences of intercompany billing and inter-project billing.

PPM is not Fusion Intercompany. Fusion Intercompany allows the Accounting department to create General Ledger Journals and AR/AP Invoices across Legal Entities. These entries are initiated in Fusion Intercompany and not the subledger(s). The accounting team determines the amount to charge the other legal entity and enters the entry into the Fusion Intercompany module. Often the calculation of the amount to cross charge is a manual process.

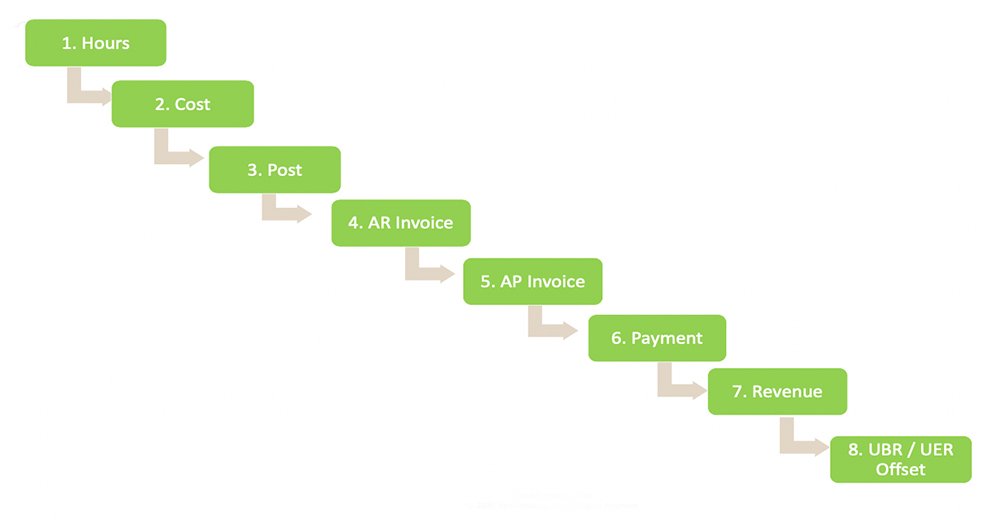

Intercompany in PPM is functionality within the Projects module that automates intercompany AR/AP Invoicing and Journal Entries between Legal Entities. Below is a high level explanation of how intercompany works in PPM. In the example below a DE Employee (Provider) is working on a UK project (Receiver).

Note: To date cross charging between Provider and Receiver is only allowed on non-capital projects. We believe, this feature in on the PPM roadmap.

DE EMPLOYEE WORKS ON A UK PROJECT

1.) The UK project is enabled for cross charge for DE Business Unit employees. The DE employee enters time against the UK project on their timecard. The time can be entered into Oracle Fusion Time and Labor or a third party timecard system.

2.) Hours are imported into the DE Business Unit.

3.) Hours are costed in the DE Business Unit using the DE Cost Rate Schedule. The Labor cost is then posted to the DE Ledger.

Dr Expense

Cr Clearing

4.) The DE team runs processes to create the AR Intercompany invoice. The invoice amount is based on the transfer price rules setup between the legal entities and the transfer price currency conversion setups.

Dr I/C Receivables

Cr I/C Deferred Revenue

5.) After the receivable invoice has been transferred to AR and confirmed in PPM, a Payables Invoice in the UK is automatically created.

Dr I/C Cost

Cr I/C AP

6.) The UK pays the DE for the provided resource(s)

Dr I/C AP

Cr Cash

7.) The DE runs processes to record the intercompany revenue to offset the expense

Dr I/C Unbilled Receivable

Cr I/C Revenue

8.) Finally, the billing offset program is run to true up the deferred revenue and unbilled receivables amount.

Dr I/C Deferred Revenue

Cr I/C Unbilled Receivable

Using intercompany in PPM, saves organizations countless hours of trying to manually determine amounts to cross charge and the subsequent journal entries.

In the next blog post, we will highlight some of the key Intercompany setups and the key decisions required for your implementation.

NOTES:

- For assistance with PPM setups please contact us at https://transformious.com/contactus/

- For permission to repost this blog contact us at https://transformious.com/contactus/